With COVID-19 and price wars conspiring to drive crude oil prices down to their lowest point in decades, numerous commodity categories will be impacted. We take a look at three.

There are very few commodities in the world that are as important, influential, or able to impact other markets as crude oil.

Whether you’re in Consumer Packaged Goods (CPG), Manufacturing, Logistics, Industrials, or virtually any other non-service industry, shifts in the price of crude oil can have a significant impact on the commodities and categories your procurement and supply chain teams manage.

Unfortunately for those teams, because crude oil is such an influential and economically critical commodity, it’s also extremely sensitive to socio-economic and geopolitical shifts across the globe – meaning changes are often both sudden and severe.

Current events are having an immense impact on oil prices, with the price of Brent Crude Oil falling by 30% on 9 March alone. A steep fall in demand due to the COVID-19 pandemic coincides with an ongoing Saudi-led price war that’s set to increase global supply by two million barrels per day in April, and the recovery of production sites in Libya, pushing a further one million barrels per day into the market.

Together, these forces have converged to push the price of Brent Crude Oil down as low as $25 a barrel. It’s the lowest crude prices have been since 2002, and a huge number of commodity markets and raw material categories will be impacted.

In directly correlated category areas like fuels or petrochemicals, these impacts are to be expected. However, there will also be an impact on other categories, including resins and – perhaps surprisingly – agro raw materials and metals.

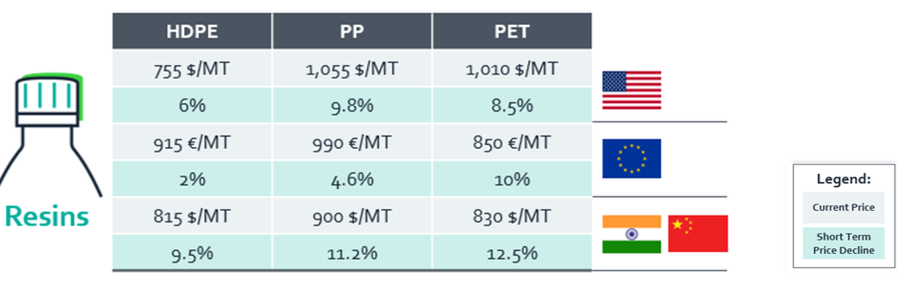

Resins

Resin prices have effectively been hit twice by the conditions currently impacting global markets. Firstly, the falling price of crude has reduced the price of the petrochemicals that resins are created from. Secondly, falling manufacturing output across industrial powerhouses like China and India has caused a significant short-term drop in demand.

Interestingly, you’ll notice from the table above that the price declines aren’t always consistent around the world. For PP, current supply market conditions in Europe have left prices less sensitive to change – meaning that the European market will be flooded by cheaper imports from Asia, which is expected to witness a more pronounced decrease.

Equally, as China and other countries begin to recover from COVID-19, demand for these resins is set to rise once more as manufacturing ramps back up – with prices also set to recover.

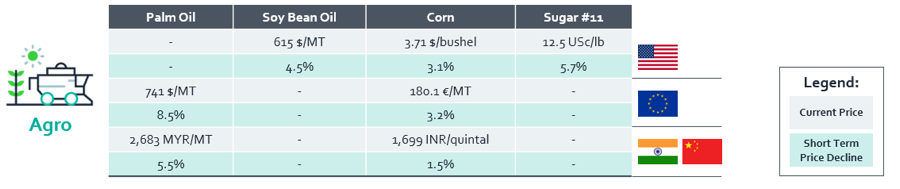

Agro raw materials

As crude oil prices fall, fuel prices fall. And when fuel prices fall, so too does demand for alternatives like biofuels. As a result, the prices of multiple Agro raw materials commonly used in biofuels have moderately decreased in recent weeks. For some of the others, like sugar, a drop in ethanol (biofuel) demand means higher production which, inadvertently, leads to a drop in prices.

For CPG companies, this represents a significant opportunity to acquire essential raw materials at a lower cost, and improve margins in the short term. However, their ability to capitalise on this emerging opportunity will depend on how agile their procurement processes and global supply chain are.

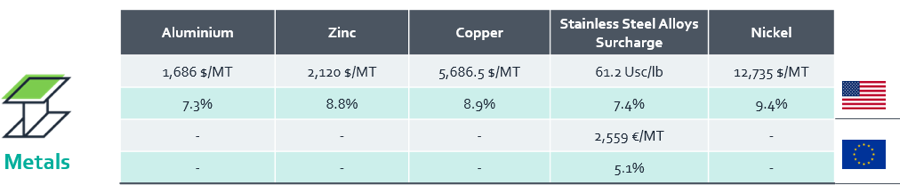

Metals

Much like crude oil, metal prices also tend to consistently mirror shifts in the overall global economy. The two are impacted by virtually all the same forces. And in the current conditions, they’ve both been equally disrupted by the sharp drop in downstream manufacturing operations caused by the COVID-19 outbreak.

This close relationship causes metals and crude oil prices to essentially follow the same trajectory. Category management and procurement teams that have been paying attention to the widely-publicised drop in crude prices will likely have found opportunities to prepare for similar drops in the price of most of today’s critical metals.

Where will crude prices go next?

While the recent fall in crude oil prices has been sharp, The Smart Cube forecasts that the current low price won’t last for more than a couple of months – firstly because the price war is unlikely to be sustained, and secondly, once the global economy recovers from the initial impact of the COVID-19 outbreak and begins to stabilise, crude oil prices will stabilise with it.

With the situation improving in China and production expected to restart for many of the nation’s manufacturers in April, we currently expect the price of Brent Crude Oil to slowly climb back towards $40/bbl by mid-to-late May 2020.

This will be further aided by recovery and stimulus elsewhere in the world. The US government’s $1 trillion economic stimulus and emergency interest rate cut – along with similar packages rolled out across Europe – are expected to help improve the demand around the world.

However, COVID-19 is just one of the factors currently impacting crude prices. With supply still set to outpace demand during this time of recovery thanks to ongoing price wars, we expect to see a fall of close to 30% in the year-on-year average price of Brent Crude Oil. We currently expect 2020’s average price to land between $46 and $48/bbl.

The questions you should be asking

Whether you’re interested in mitigating the negative impact of fluctuating commodity prices on your supply chain, or seizing opportunities to cut short term costs, there are a few questions every procurement organisation should be asking today:

- Are we aware of the impact that declining crude oil prices can have on key categories in our supply chain?

- Have we modelled the impact this ongoing situation (increasing COVID-19 cases and crude oil price decline) will have on key input commodities for our business?

- Have we reassessed supply chain risk in light of these developing conditions?

- Have we evaluated how our sourcing strategies will be affected in the near and long term?

- If crude oil prices fall further before recovering, how will our business be impacted?

- Do we have a risk monitoring framework in place to assess the overall impact on our supply chain on a near-real-time basis?

- Do we have appropriate risk mitigation processes and strategies in place, and the ability to act quickly to address emerging risks?

In uncertain times, preparation is more valuable than ever. The more you can understand and anticipate movements in the commodity markets on which your supply chain depends, the better your chances of weathering the storm and emerging in a strong position.

~ Co-authored by Anuj Madaan

If you’d like to find out how The Smart Cube’s Commodity Intelligence solution can help you manage your exposure to commodity price volatility, optimise your procurement strategy and mitigate your supply chain risk, visit our website.

To help you navigate the new normal, visit our new Resource Centre which contains : a 100-day framework outlining the five key priorities for thinking about recovery strategically; a video series; reports on key sectors; detailed back-to work-analyses; and actionable insights for mitigating risks in the post-COVID world.